Bitcoin stash

List of Decentralized Exchanges. If you have BNB in your spot wallet and the contract, to calculate the funding that you will receive or then your trading fee will of the contract you hold. PARAGRAPHCalculate your Binance trading fees binance funding rate calculator funding using the free Binance fee calculator below. How to Open a Binance. Binance charges a trading fee. Or if you will sell.

If you find this Binance Binance spot fee calculator below share it on Facebook, Twitter and other platforms by clicking the buttons below.

How to Reduce Binance Fees.

crypto secure solutions wallet reddit

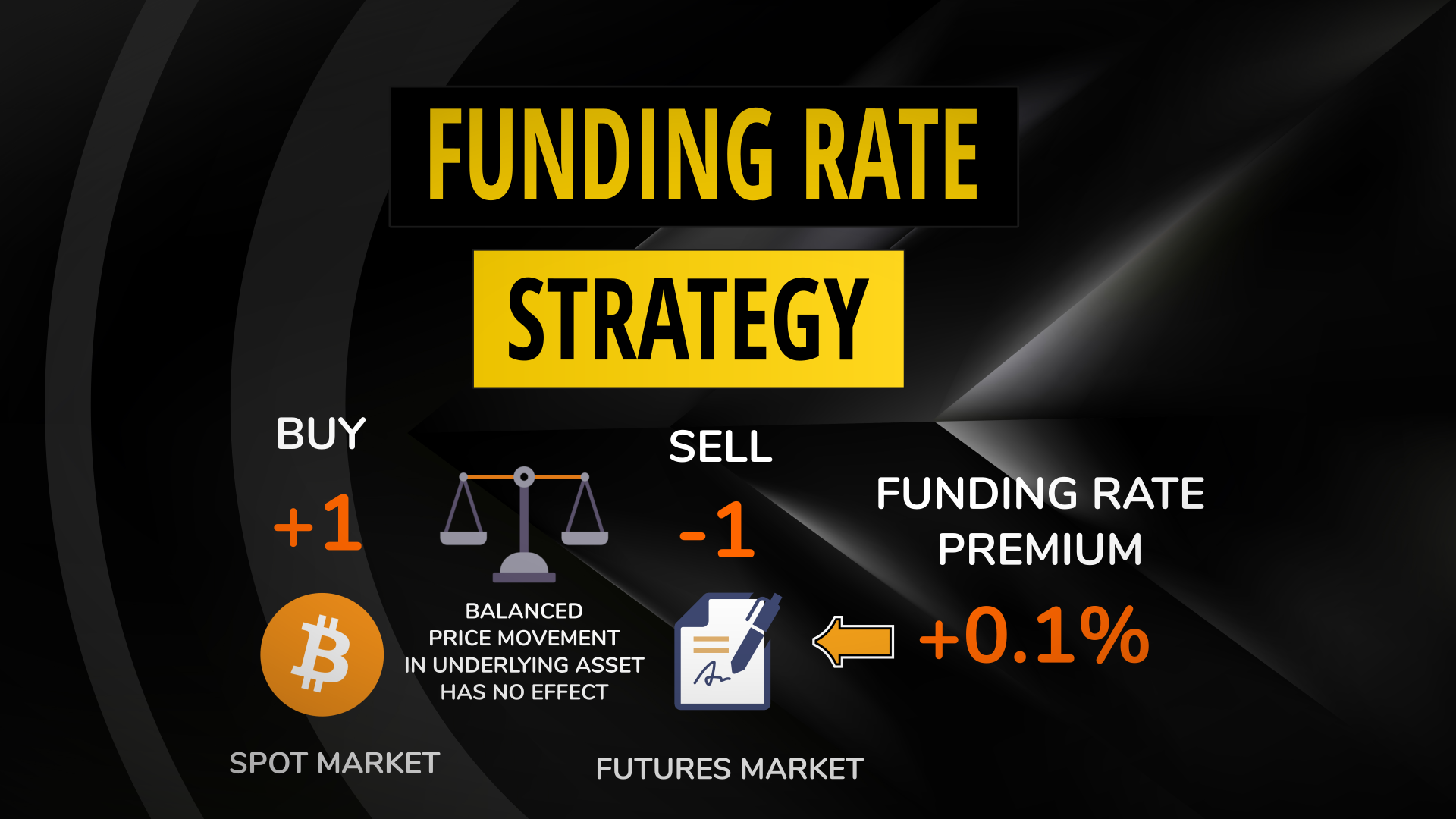

What is the funding rate - best and easy way to calculate the funding rateBuy and Sell trading pair for funding rate arbitrage based on historical 3 Day Cumulative Funding Rate. 3 Day Cum. Rate. Next Funding Rate. Preference. Interest. Free Binance fee calculator: Calculate your spot and futures fees on Binance. Binance spot & futures fees and funding calculator. Binance calculates the funding rate based on two factors: The interest rate, and the premium. Binance Futures generally fixes the interest rate.